State intervention is no substitute for innovation

First published in spiked, October 2009

First published in spiked, October 2009British industry isn’t dead by any means, but if low-carbon jobs and protectionism trump new research and development, it soon will be.

Should governments in Britain intervene in the economy to ensure that the nation’s industrial base is preserved? That’s the question addressed in Nations Choose Prosperity: Why Britain Needs an Industrial Policy, a useful collection of essays, including substantial contributions by free-market economist Ruth Lea and by David G Green, director of the think tank Civitas.

At the outset it is worth realising that there are no easy answers to the question of industrial policy. The postwar record of government intervention in UK industry has not been a happy one, and is very much coloured by the disastrous experience of taking over car manufacturing at British Leyland in the 1970s. There is no need to be nostalgic about the past role of industry in the British economy. And, in principle, there is no reason why, in a future global division of labour, imports of manufactures from Asia should not make UK manufacturing wholly or nearly redundant.

However, while that might be true in principle, as a theoretical possibility, there will always be products, power supplies, buildings and other hard goods in Britain that will be in need of maintenance and repair. In this sense, familiarity with engineering and components will remain important to the UK even in the absence of an industrial base – unless it is imagined that immigrant engineers can be ferried in whenever needed. The loss of hardware-orientated skills indigenous to the UK is already a concern in relation to the task of building a new generation of nuclear reactors. To have everyone educated only in services in the long-term future might appear realistic, but is in fact a utopia.

Anyway, as Ruth Lea argues, manufacturing – which is only part of the wider sector termed ‘industry’ – is, even now, more than one-and-a-half times bigger than the financial sector. It accounts for 13 per cent of UK gross domestic product, 10 per cent of total employment (three million people), half of UK exports, and 75 per cent of business research and development (R&D). Between 1979 and 2008, the annual average growth in productivity in manufacturing was, at 3.4 per cent, nearly double that of the economy as a whole. It is the relative ease of raising productivity in manufacturing that, in part, accounts for the dwindling number of jobs in the sector.

In 2008, however, Britain ran a deficit in traded, visible goods approaching £100billion. As Lea points out, given the problems in UK financial services and the decline of North Sea oil, better manufacturing may be the only plausible way of redressing this balance.

As Lea notes, pharmaceuticals are a British strength. Aerospace is also relatively healthy – aided, though Lea doesn’t mention it, by the requirements of the Ministry of Defence. Lea doesn’t dwell on the UK car industry, but its weight is, in fact, quite surprising. Taking into account the service employment connected to it, it accounts for about 800,000 jobs. The UK hosts seven global volume manufacturers: Honda, Nissan, Toyota, BMW, Volkswagen, Ford and GM, as well as specialists including Jaguar, Rover, Aston Martin, Lotus, and various players in trucks and buses. Output is more than a million vehicles a year, and Britain remains the world’s second largest manufacturer of engines (three million a year), and the world’s second largest manufacturer, next to Germany, of premier or luxury cars.

Known for her combative, right-wing stance on economics, Lea is forced by the facts not to uphold any Thatcherite vision of Britain as a service-based Hong Kong of Europe. It is odd, but realism dictates that industry in Britain cannot just be wished away. That, however, is a different thing from saying that government should actively intervene in industry – supposing, of course, that it had the money actually to do things there. Yet here we find the second interesting feature of this pamphlet: David Green makes what he calls ‘the free-market case for industrial policy’.

A free-market liberal backs the state

Green’s debt is to Adam Smith, the Harvard management guru and economist Michael Porter, and the Harvard economist Dani Rodrik. First, Green argues that it was the strong pound in the 1980s and early 1990s that undid UK manufacturing, not its basic performance, which was creditable. So for him, better macroeconomic policy and deregulation (around working time, money laundering and employment tribunals) would help, along with less corporation tax and stronger capital allowances for plant, machinery and industrial buildings. The government’s role is to take care of relevant skills and infrastructure – a Smithian formula with which it is hard to disagree.

Bizarrely, however, Green agrees with the UK business secretary, Lord Mandelson, that the British government is focusing ‘too narrowly’ on supporting R&D. Instead, following Porter, Green argues that the government should take demand-side measures, insisting on high standards and creating early demand for new products, while avoiding any attempt to pick particular companies as ‘national champions’.

At the moment, UK environmentalists approve of the British state creating demand for wind turbines and other renewable sources of energy. But Green seems oblivious to the way in which New Labour’s Renewables Obligation Certificates have helped create ‘demand’ for renewables among electricity suppliers, but, in the process, massively overestimated the contribution that such sources of energy can reasonably be expected to make. Meanwhile, New Labour has let the UK’s government and business R&D base deteriorate, and sees little role for the legitimate state sponsorship of basic, long-term research.

For Green, following Rodrik, there is no big problem in ‘picking winners’, as long as the state does not pick losers. But picking losers is what the state has done with wind power, just as it has picked dodgy banks for its support. Meanwhile, efforts to make state procurement policies encourage innovation have, as Green observes, accomplished little.

Given all these failures, Green’s cavalier attitude to R&D is remarkable. But there is more. He favours an industrial policy so that ‘our’ industries are ‘not picked off one at a time by overseas rivals with more supportive governments’. He also notes that 40 per cent of UK corporate voting shares are owned overseas. Altogether, Green makes a free-market case for… protectionism. We should not be dumbfounded if, should they be elected to office, the Conservatives beat a similarly aggressive and patriotic drum.

Green concludes by invoking Porter to attack the short-termist perspective of institutional investors toward manufacturing – especially pension funds, despite the fact that, as he himself states, these bodies now own just 13 per cent of UK shares. For Green, the City is a villain for focusing on share prices and corporate acquisitions, rather than management and innovation. His solution is our old friend, shareholder democracy – encouraging ‘more people to take a chance on investing in our future prosperity’, and, in free-market style, making sure that business ownership and control are more closely aligned.

Here Green misses two things. First, the old debate about short-termism needs to be re-interpreted in the light of society’s – and especially Britain’s – aversion to risk. The refusal of the financial powerhouses in the City of London to support industrial innovation, like the government’s, is not simply an economic question, but a cultural one. Neither body knows much about science or technology; both fear them as dangerous bets to make. When a whole society is suffused with a sense of foreboding about the future, if not the sense that the planet will shortly come to an end, it’s hardly surprising that the City looks at today’s share prices rather than investing in innovation.

Second, American workers’ experience of Employee Share Ownership Plans (ESOPs) has been very negative. Millions have lost the money they thought would make up for inadequate wages. Owning shares is not about investing in future prosperity, but about mortgaging one’s future to the fortunes of capitalism – given recent events, this is a dubious strategy.

Clever energy buffs, foolish trade union types

For those familiar with Professor Ian Fells and Candida Whitmill and their excellent work on Britain’s forthcoming ‘energy gap’, their chapter in Nations Choose Prosperity makes familiar reading. They are suitably scathing about the current state of British wind-power production, rightly indict New Labour for failing to fund R&D in carbon capture and storage, put in a sensible word for tidal barrages (‘proven technology’), and appear rather too hopeful that politicians will really favour nuclear power. They are rightly worried that today’s credit squeeze will impair investment in energy supply ‘of whatever kind’, and correctly point out that the National Grid requires substantial investment.

The most hilarious contribution to the pamphlet is by Trades Union Congress (TUC) general secretary Brendan Barber. True to form, the labour movement carthorse slouches after Gordon Brown’s call to ‘industrial activism’, Building Britain’s Future: New Industry, New Jobs (2009). Barber wants British manufacturing to specialise, which is fair enough. But specialise in what? For him, ‘the whole development of low-carbon technology provides a massive opportunity’.

This is wonderful. Britain, renowned as the dirty man of Europe, should move out of metals and go for low carbon through composite materials, applying them in automotive, marine, aerospace, wind and wave, construction, oil and gas, medical equipment and electronics. That would be a great idea – if Britain had a wind-turbine manufacturer (it doesn’t), if wave power was a serious contender in energy supply (it isn’t), and if oil and gas were ‘low carbon’ (they aren’t).

Anyway, as Ruth Lea mentions, Britain is largely out of metals anyway (along with textiles and a lot of food and drink, she adds). Where, as in aerospace, composites make sense because of their strength-to-weight ratio and, thus, low fuel-requirements, they are already in the field to a greater or lesser degree (think car bumpers). But often composites do not make sense: they are labour-intensive in manufacture (a matter of no significance to carbonistas), and thus often prohibitive in cost.

For all his praise for manufacturing and science, Barber appears to know as little about these subjects as Gordon Brown. Perhaps that is because the TUC is really a minor subsidiary of the government: through unionlearn, Barber attests, it aims to give 250,000 ‘individual learners’ skills – alongside its campaigns for fair trade and for greening the workplace. So it’s now down not to state- or employer-led education to improve Britain’s skills base, but to union members who have their dues checked off from their monthly pay.

Barber is not alone. Ian Brinkley, director of the Knowledge Economy (the capitals are his) at the Work Foundation and previously a top economist at the TUC, tells us that ‘the UK’s non-financial knowledge-based economy will be a source of stability for jobs and investment in the recession’. He is right to say that manufacturing firms now integrate high value-added services into the production process – though this hardly counts as what he hails as a new sector, namely ‘manu-services’. But his grasp of economic categories is as firm as Barber’s understanding of technology. He defines knowledge-based intangibles as stretching from R&D to software, design, brand equity, human capital and organisational capital, going on to argue that manufacturing invests more than services in these.

It’s true that service firms worldwide have a lamentable record in R&D. But like Green, Brinkley would rather not talk up R&D too much: three quarters of modern manufacturing’s investment in knowledge-based intangibles, he says, lies outside R&D. These intangibles, for him, explain why low-tech UK sectors such as printing and publishing have withstood foreign competition.

In fact, there is nothing knowledge-based about brand equity, for example – a category that, like human capital and organisational capital, Brinkley fails to expand on. And isn’t the survival of British printing and publishing something to do with low wages in these sectors, rather than the stock of knowledge in them? Given that Britain’s world-beating banks don’t even know where their toxic assets are, we can be certain that ignorance, like low R&D spending, will delay the arrival of the much vaunted knowledge economy in Britain for some years yet.

A kulturkampf is needed!

What are we to make of the main ideas covered by these essays? Green’s debt to Porter’s Competitive Advantage of Nations, which he dates as published in 1998 when it is, in fact, 20 years old, is sad. For Porter, ‘nations choose prosperity’ in the sense that clusters of firms, and governments, determine many of a company’s competitive advantages. Here, Alfred Marshall’s familiar but diversionary focus on the externalities surrounding a firm, rather than its participation in general, society-wide rates of exploitation and profit, is what counts. But the idea that nations choose prosperity is ridiculous, and particularly ridiculous coming from a free marketer. It is the unconscious action of market forces, not the muddled plans of the capitalist state, which establish prosperity or poverty. Until the TUC made greening the workplace its priority, the class struggle, which divides national populations, has played an important historical role here, too.

That said, a truly knowledgeable state, even a capitalist one, could make a difference at the margins – as already argued – in education (especially science and technology, and especially not branding), infrastructure (especially energy) and basic research. As Rob Killick has recently argued here, the state could also lead public opinion by campaigning for nuclear power, better roads, genetically modified crops and other supposedly unacceptable risks. Pharmaceuticals could also do with some public defenders, rather than always receiving the kind of abuse epitomised by John Le Carré‘s The Constant Gardener.

One does not need to be a free-marketeer to feel that large-scale state intervention in industry, like that in private life, is likely to have unhappy consequences. Protectionism is even more dangerous, and even tax regimes that favour industrial investment and R&D don’t really set my heart aflutter. How the government could make a difference is, for example, by cutting through the cacophony of voices telling us to save energy or make energy-efficient products. Instead, the state should proclaim the need for, and perhaps provide some sensible incentives for, investment in high-tech, R&D-intensive energy supply.

That is what an industrial policy should really mean: a wide-ranging political struggle in favour of valuing the risk-taking achievements, past, present and future, of industry. We need what the Germans call a kulturkampf – a cultural war in favour of industry engaging in serious innovation and R&D.

And yes, Britain’s services need to join in that war for progress, too.

Nations Choose Prosperity: Why Britain Needs an Industrial Policy, edited by Ruth Lea, is published by Civitas. (Buy this book from Amazon(UK).)

Fmr President of Kenya on Trump cutting off foreign aid:

“Why are you crying? It’s not your government, he has no reason to give you anything. This is a wakeup call to say what are we going to do to help ourselves?”

America first is good for the world.

Our entire Green Socialist establishment should be banged up under the ‘Online Safety’ laws, for spreading demonstrable lies (the ‘climate crisis’), causing non-trivial harm to the industrial working class, ordinary drivers, farmers, taxpayers etc, etc.

#Chagos? #Mauritius PM Navin Ramgoolam "is reported to want Starmer to pay £800m a year, plus ‘billions of pounds in #reparations’." (14 January) https://www.spiked-online.com/2025/01/14/the-chagos-islands-deal-is-an-embarrassment/

Now the Torygraph wakes up https://telegraph.co.uk/gift/1ff8abbb462cd609

Read @spikedonline - first with the news!

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

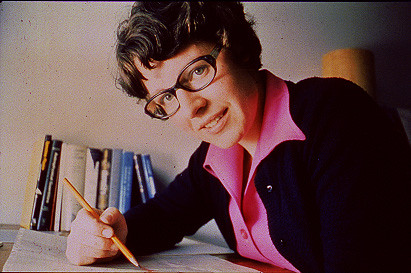

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

Eugene Polley – TV remote controls

0 comments