New dawn rising for Eastern IT

First published in Computing, October 2008

First published in Computing, October 2008The financial crisis in the West will strengthen the position of IT firms in the East.

More than four years ago, when Legend, a manufacturer of laptop PCs, had yet to become Lenovo, I wrote a piece for IT Week suggesting that the Chinese firm was right to splash out £38m on sponsoring the Beijing Olympics and that, alongside Eastern IT firms generally, it faced a great future.

Little did I know then how the failure of Wall Street would follow the success of the Olympics.

With shares in IT companies now falling, and Lenovo’s trade at near its historic lows, we can nonetheless expect that the financial crisis in the West will strengthen the position of IT firms in the East. It will take time, and Asia may have to toil for some years to develop anything like Microsoft. But in hardware, Lenovo already boasts its own industrial design department. Meanwhile, in software, India is producing its own contenders, such as Infosys and HCL. These two have recently been in a £400m bidding war for Axon, a UK consulting firm specialising in SAP software.

This fight over a Western services firm is a far cry from the Indian call centres that have, to date, dominated the average Briton’s experience of Asian IT. Of course, Asian IT players face tough markets in the West as the recession here worsens; Infosys and Wipro in Bangalore, along with Tata Consultancy Services in Mumbai and Satyam Computer Services in Hyderabad, have already felt the pinch not least because of their exposure to the financial services sector.

But in such times when analyst group Gartner’s annual Symposium in Cannes next month promises special sessions on cutting IT costs, the attractions of doing business with inexpensive Asian suppliers are heightened. Right now, for instance, general mergers and acquisitions (M&As) around the world have slackened (bar emergency tie-ups in the embattled financial services sector), so opportunities for IT integration work have dropped off too. But once cash-rich companies spot bargains and M&A picks up, the Indians will be in there, pulling different systems together.

And the Asian companies may emerge from these straitened times in good shape. The scale of general infrastructure in both China and India promises to provide significant work for IT companies in those countries work which will increase their experience and clout.

China, for instance, plans to build more than one million kilometres of new roads between now and 2020. It’s inconceivable that such an undertaking will not be accompanied by rapid developments in telecommunications.

Mobile technology may become the proving ground for this Eastern ascent. China Mobile, along with China Telecom and China Unicom, boast a user base of 600 million people but penetration rates are little more than 40 per cent.

Meanwhile in India, Bharti Airtel, a £23bn Indian mobile operator, launched an unsuccessful bid for South Africa’s MTN. Despite that setback, it remains fixed on international expansion, and – in an era of write-downs may now find some other acquisition targets.

Sitting in a tube train carriage the other day, my eyes alighted on adverts for South Korea’s Samsung. They were chic, colourful, and ran in a riveting sequence across no fewer than four strips of new cardboard. They promoted Samsung’s latest handset, the U700.

OK, so the U700 doesn’t have all of the features boasted by Apple’s iPhone. But it does make videos and simultaneous voice recordings. And it also offers HSDPA at super-fast speeds and was the first time I’d seen that abbreviation on the humble London Underground.

If Samsung can make such an impact in a market that seems to be sewn up by Western manufacturers, there can be only one conclusion: Asian IT looks set to conquer the world.

Fmr President of Kenya on Trump cutting off foreign aid:

“Why are you crying? It’s not your government, he has no reason to give you anything. This is a wakeup call to say what are we going to do to help ourselves?”

America first is good for the world.

Our entire Green Socialist establishment should be banged up under the ‘Online Safety’ laws, for spreading demonstrable lies (the ‘climate crisis’), causing non-trivial harm to the industrial working class, ordinary drivers, farmers, taxpayers etc, etc.

#Chagos? #Mauritius PM Navin Ramgoolam "is reported to want Starmer to pay £800m a year, plus ‘billions of pounds in #reparations’." (14 January) https://www.spiked-online.com/2025/01/14/the-chagos-islands-deal-is-an-embarrassment/

Now the Torygraph wakes up https://telegraph.co.uk/gift/1ff8abbb462cd609

Read @spikedonline - first with the news!

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

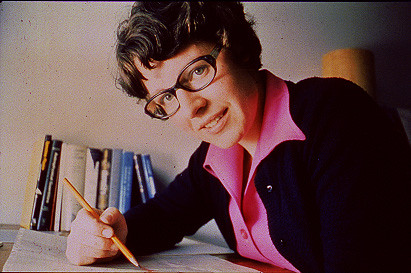

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

Eugene Polley – TV remote controls

0 comments