Electric car, Made in China

First published by IDG Connect, July 2017

First published by IDG Connect, July 2017Few in the West have taken the full measure of China’s drive toward electric vehicles

According to the International Energy Agency, in 2016 the world’s stock of electric light-duty passenger vehicles for the first time surpassed two million. That amounted to just 0.2 per cent of the total light-duty passenger vehicles moving around the planet.

Clearly the electric vehicles industry is still a young one, even if a bullish UBS forecast gives them a full 14 per cent penetration of the global market for vehicles in 2025. Just as clearly, however, China will play a major role – perhaps the major role – in the future development of electric road transport.

In 2016, China for the first time ran more electric cars than America – 649,000 against 564,000. That year, too, Chinese motorists bought about 257,000 all-electric cars and 79,000 petrol-electric hybrids: double the total sold in the US, and more than 40 per cent of all the 750,000 fully or partly electric cars sold around the world. Then, in April 2017, China’s Ministry of Industry and Information Technology issued guidance: it now wants no fewer than two million electric cars on China’s roads by 2020, and more than seven million by 2025.

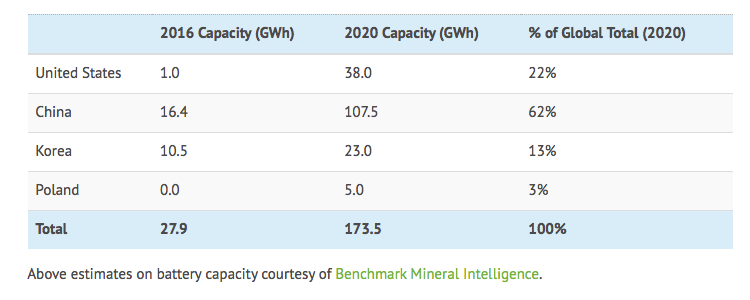

In electric car batteries, too, Chinese domination is also growing. This year, the Chinese government called upon domestic makers of batteries to double capacity by 2020. By that date, some predict, giant Chinese factories could be making 62 per cent of the world’s lithium-ion cells:

In lithium-ion, production at CATL could by 2020 surpass that at Panasonic, currently the world’s largest battery producer. Already China has attracted foreign lithium-ion battery specialists such as Germany’s Dynavolt. Also, the government of Hubei province, home to China’s second-largest carmaker, Dongfeng Motor Group Co, is working with Chinese private equity firm GSR Capital to make what, for China, is an unprecedented investment in Japan: for $1bn, the two want a stake in Automotive Energy Supply Corp, a battery manufacturer owned by Nissan Motor and NEC, and one that supplies the Nissan Leaf.

There’s something else about China and electric car batteries. Batteries, as well as electric car motors, depend specially on supplies of particular commodities – and these supplies, China has organised in abundance.

In lithium, the world’s largest electric carmaker, BYD (Build Your Dreams), seeks deals with Chilean suppliers, and Ganfeng Lithium has interests in Australia and Argentina. Similarly, China is strong in cobalt for batteries: it handles about half of the world’s cobalt processing. Beijing Easpring Material Technology Co. Ltd claims to supply five of the world’s six largest lithium battery manufacturers; in the Democratic Republic of the Congo, source of most of China’s cobalt, the company works with Huawei and others in the Responsible Cobalt Initiative, to combat ‘the worst forms of child labour’.

In rare earths, which in electric cars appear in both batteries and motors, China has long been vilified for its strong production position. Finally, China is also well placed in the battery materials nickel and graphite. China’s top 10 nickel mines produce nearly 200,000 tonnes of the metal each year, and have reserves of about 480m tonnes. Northeast China also mines nearly all of the world’s naturally sourced spherical graphite, as distinct from the synthetic sort.

Moving on to the delivery of power to electric cars, China again emerges as a leader. No less than 81 per cent of the world’s fast charging infrastructure for electric cars lies within its borders. Aimed at beating ‘range anxiety’ on the part of drivers, the number of fast electric charging stations on China’s highways in 2016 reached 90,000. Eventually, perhaps, the wireless charging of electric cars may be done while driving, from cables under the road. As a first step toward this, China has – with American help, it’s true – already demonstrated a wireless charging station.

The batteries in electric cars, their relatively exotic ingredients, the need to charge them: these three facts underline just how little such cars resemble conventional ones. But in fact, the differences don’t end there.

Engines on Volkswagen Golfs, for instance, consist of 113 parts – but there are only three in the electric motor on GM’s mass-market electric car, the 200-mile-range-and-up Chevrolet Bolt. Electric cars likewise dispense with transmission, clutch, mufflers, particulate filters, fuel tanks, starters, alternators and spark plugs. On the other hand, the 100V-and-higher batteries in electric cars demand special kinds of power electronics to handle battery management, auxiliary power, braking, valve timing, cruise control, security and instrument arrays. Here the prospect is for reliable, long-life systems based on fast-switching, heat-resistant Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductors that make DC-to-AC inverters four times more powerful, halve their cost, and cut their size and weight by 75 per cent. And guess what? In power electronics China is again a massive force: partly because of its position in electric cars, it’s estimated to account for perhaps 34 per cent of the Asia-Pacific market for general power electronics, with Asia-Pac representing more than half the global market.

From batteries, raw materials and charging through to power electronics, therefore, China is the country that’s most in at the birth of the electric car as a new species in its own right. The enormous factories making tomorrow’s lithium-ion batteries constitute a new industry; and so does the electric car.

In its supply chains and its sales, China will call a lot of the shots in the brave new world of electric cars. But in fact the argument goes further.

Right now the world economy, and even high-growth China, desperately needs new sectors of wealth creation to open up: special sectors that are high-tech, but which can provide durable new jobs by the million. Along with cyber-security and quantum computing, electric cars – machines that themselves will depend on good cyber-security – could be one of those sectors. In Sunderland, UK for example, Renault Nissan has sold 20,000 of its Leaf, and plans a 340-mile version in September 2017. Products like that could transform prospects in a ‘left-behind’, pro-Brexit region like Britain’s north east, just as they might help transform the American mid-West.

Yet in the race for electric cars, China has three advantages over the Renault Nissan and the West. First, Western car companies, especially mass-market brands, may prove reluctant to ‘cannibalise’ their existing business by diverting effort going into electric cars, which are still a loss-making item. By contrast the Chinese drive to manufacture electric cars starts from a fairly clean sheet of paper. In China, more than 30 domestic brands together take only 40 per cent of the car market. A shake-out is coming, leaving perhaps only five giant players – and we can be sure that these companies will be Giants of the Global Electric Car.

Second, Western governments and environmentalists, who have long held reservations about electric cars, are now nervous about their effect on the established electrical grid.

Third and perhaps most important, people aren’t really noticing China’s expertise in electric cars. Western visions of the automotive future are driverless much more than they are electric. What are celebrated is experiments in autonomous cars pioneered by Apple, Google’s parent Alphabet, Uber and others – even if, about their more proven but less exciting electric cousins, it’s conceded that the battle will be between Tesla in the US and Germany’s lithium-rich ‘Silicon Saxony’. China? Its inhabitants now leap aboard more than 200m electric two-wheelers and more than 300,000 electric buses. There, GM plans to start manufacturing all-electric vehicles within two years, and to sell more than half a million hybrid and all-electric cars in 2025. Tesla made $1 billion there in 2016, Elon Musk has said that China will someday become the electric automaker’s top market, and Volkswagen has threatened a vigorous riposte. Daimler has bought a minority share in Beijing Electric Vehicle Co., Ltd. (BJEV), a subsidiary of the electric vehicle maker BAIC Group. But apart from these rather under-the-bonnet commercial deals, few in the West have taken the full measure of China’s drive toward electric vehicles.

The myopia is striking. In the autonomous-car ‘Passenger Economy’ recently projected by Intel, electric cars are hardly mentioned, and China only appears, next to India, as a country whose myriad traffic deaths could be mitigated by autonomy. Far from China changing what the world understands by cars, US IT platforms, developed out of those currently provided by ride-hailing apps Uber, Lyft, Didi and their rivals, are seen as changing what America looks like. Thus, for Stanford University, low-cost, driverless and, yes, electric ‘transport as a service’ (TaaS) in US cities will end all sales of normal cars by 2024. Indeed, the intensive utilisation of the vehicles hired for TaaS will help downsize America’s car fleet from 247m to just 44m, 2020-30, bringing the US unclogged roads, new and vast tracts of land, and… 100 million abandoned vehicles.

Compared with what’s really happening on the ground now, these visions are way off beam. They miss how fixing urban air pollution by going electric is a vital part of the Communist Party’s plans to retain public legitimacy. They downplay the fact that China is becoming a consumer society, with car purchases far exceeding those in the US.

In the US, the Wall Street Journal says that taxi fleets and government entities are China’s main buyers of electric cars, and reports ‘anecdotally’ that such vehicles are flimsy and tiny, wouldn’t pass crash tests and have batteries that quickly go bad. Similarly, MIT’s Technology Review highlights how, since the Chinese government ended hefty subsidies for purchases of electric cars, sales dropped 34 per cent at BYD, in which Warren Buffett is invested. Last, it has for years been clear that fossil fuels will be the main source of electricity in China for a long time to come; so it can certainly be argued the benefits of EVs to China in terms of greenhouse gas emissions and more general national pollution are questionable. The continuing fossil fuel base of China’s electricity is clearly damaging to cities where coal is mined and fed to power plants, even if cities like Beijing and Shanghai, where smog can be high, will make some gains through switching to electric cars.

But all these objections to Chinese electric cars, like the setback they’ll likely receive in any major slump, will not prevent them from eventually conquering. And that may prove as vital to the world economy in the future as the mobile phone has been in the decades preceding 2017. Unlike the driverless car, the electric car is a reality now. In 10 years’ time, and for urban door-to-door trips and for families, it will grow from a niche proposition to a truly mass-market phenomenon. Finally, it will be China that makes and sells the most electric cars, and sets the pace for other nations to follow.

Good luck to the #farmers on their march today!

I probably don't need to tell you to wrap up warm. But please remember that no part of the UK's green agenda is your friend. All of it is intended to deprive you of your livelihood, one way or another. That is its design.

Brilliant piece by @danielbenami. RECOMMENDED

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

Eugene Polley – TV remote controls

0 comments