China’s productivity

First published by GIS, December 2015

First published by GIS, December 2015The use of labour has been China’s main economic strength. Can it move beyond that?

We’ve heard the story. Wages in China have risen compared with much of the rest of Asia, making it less competitive. Like other members of the BRICS, China is stuck in the ‘middle income trap’ that afflicts emerging, costlier economies unable to compete in high-value goods and services. China’s productivity is about a third of Korea’s; sales per employee in telecommunications and pharmaceuticals are less than a third of America’s.

While it has poured money into ‘upstream’ industries such as steel, China has yet to show that its expenditure on plant and equipment has gained it much by way of productivity. China’s new five-year plan, therefore, may trumpet the need for innovation as much as it likes; but China continues to be an innovation and productivity laggard, whatever its brute funding on R&D and its brute performance in patents might otherwise suggest.

We’ve heard this story on productivity, but it tends toward glibness – like the familiar stories of pure quantity, not quality in patents, or of imitation, not innovation (see also Chinese innovation assessed). Let’s go through the charge sheet laid against the Middle Kingdom, and see how much the accusations made against it stack up.

The case against Chinese productivity

There’s no smoke without fire. China’s National Development and Reform Commission, no less, believes that nearly half of all the country’s investment, 2009-13, failed to produce results. The level of waste surrounding even those investments beyond empty residential tower blocks or empty airports is, no doubt, enormous – although we should remember that the West is not impervious to such trends. Here we find the legacy of Joseph Stalin’s approach to ‘planning’: target-driven, coercive, flat-footed. In particular, China’s 150,000 state-owned enterprises (SOEs) – and especially local ones – are still widely felt to be dinosaurs, even if reform of them has come back on the agenda. SOEs persist in being highly leveraged, yet go on paying low rates of interest – but perhaps, only for the present. Their prospects may prove pretty dire.

Enthusiastically endorsed by the Financial Times, the management consultancy McKinsey makes an indictment that goes further than a critique of SOEs. It believes that China has endured a slowdown in the kind of new-vintage, innovatory investment that is essential to productivity growth. In July, McKinsey wrote:

‘The contribution of innovation to growth (as measured by multifactor productivity) has declined in recent years. From 1990 to 2010, multifactor productivity contributed between 40 and 48 percent of GDP growth. However, over the past five years, multifactor productivity has contributed just 30 percent of GDP growth, or about 2.4 percentage points of GDP growth per year, the lowest level in 35 years. To maintain GDP growth of 5.5 to 6.5 percent per year through 2025, China will need to generate 35 to 50 percent of GDP growth (two to three percentage points) from multifactor productivity.’

McKinsey does qualify this rather pessimistic view of Chinese innovation. China, it argues, is innovative in efficiency-driven industries which are dependent on capital investment: oil and gas, steel, construction, textiles, generic pharmaceuticals and commodity chemicals, electrical equipment, semiconductor manufacture, solar panels. It has its strong points in consumer sectors such as software, smartphones, consumer electronics and – especially – household appliances. But beyond rail and telecoms gear and wind turbines, it is weak in engineering, and almost nowhere in science-based sectors such as semiconductor design, branded pharmaceuticals, biotech and specialised chemicals.

There is something in this. Moreover once we go more granular than the national economy, there are further important nuances to remember: the contrast between the heavy industry SOEs in the north and private sector exporters in the south, for instance, or the relative inefficiency, lack of finance and lack of innovation among China’s small and medium enterprises. Still, at a macroeconomic level, there remain two other factors cited that, if true, could impair China’s future performance. First, the productivity slowdown described by McKinsey could reflect not just the gradual tapering off of China’s move out of low-productivity agriculture, but also what the revered economist Stephen Roach has termed a ‘nascent structural transformation from capital-intensive manufacturing to labour-intensive services’. Second, commentators make much of China’s ageing population. Ageing, they say, makes for fewer workers, higher wages, less savings and less output. The recent relaxation of the notorious one-child-per-family policy has come too late. Worse, the Economist newspaper adds,

‘Nearly half of China’s workers aged between 50 and 64 have not completed primary school. As these unskilled people age, their productivity is likely to fall.’

How fair are all these critiques?

Exaggerated problems

It’s certainly remarkable how much Western analysts repeatedly go back to the same old chestnuts in their urge to show that China is headed for a productivity bust. The baldest of these chestnuts is wages.

Certainly Chinese wages are on the up: according to China’s National Bureau of Statistics, the national average annual wage for urban employees has risen from about RMB 16000 in 2004 to about RMB 56000 (about $9000) today. But hold on a moment. Since when have wages been the main component of production costs, even in China? Among Chinese exporters, at least, labour usually amounts to just a quarter of total outlays. It is capital equipment and materials that forms the bulk of factory expenditures; and, especially since 2006, China’s capital stock, even when measured in constant US dollars, has risen dramatically.

Anyway, wages in China are not all they seem. According to the excellent China Labour Bulletin, as growth in China has slowed, so more and more businesses have failed to pay wages in full, on time, or at all – especially if workers are older than the statutory retirement age. Also, increases in the minimum wage, which is what many factories pay little more than, have slowed, and become less widespread. The upshot is that the average monthly wage in China is now about $750 – much more than is paid out in relatively primitive apparel and toy factories in places like Vietnam and Bangladesh, but still very competitive with, say, the $2,400 a month typically earned in Japan.

If Western critics chortle too much at China’s rising wages, their unrelenting recourse to ‘multifactor’ measures of productivity also fails to convince. In a small-print footnote, McKinsey takes multifactor productivity (MFP) – otherwise known as Total Factor Productivity – as GDP growth ‘minus input factors (energy, labor, capital)’, arguing that it provides ‘a broad, indirect measure of innovation on [sic] the economy’. Well, this metric certainly is ‘broad’, and America’s Bureau of Labor Statistics blurs and makes it opaque, too, defining it as follows:

‘MFP measures reflect output per unit of a set of combined inputs. A change in MFP reflects the change in output that cannot be accounted for by the change in combined inputs. As a result, MFP measures reflect the joint effects of many factors including research and development (R&D), new technologies, economies of scale, managerial skill, and changes in the organization of production.’

In fact, MFP has always come in many different flavours, and has always had severe critics. Yet if we momentarily take it on trust, then, using statistics drawn up by the Conference Board, a US business lobby group, we find that the widespread thesis of declining MFP in China is hardly borne out:

Annual change in Total Factor Productivity, per cent

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

| Germany | 1.6 | 1.8 | 1.2 | -0.5 | -4.2 | 2.7 | 1.8 | -0.2 | -0.5 | -0.3 |

| UK | 0.1 | 1.4 | 0.6 | -1.3 | -3.9 | 0.9 | 0.6 | -1.5 | -0.4 | -0.1 |

| US | 1.3 | 0.2 | -0.2 | -1.0 | -0.2 | 2.1 | 0.1 | 0.5 | 0.6 | 0.1 |

| Japan | 0.7 | 0.5 | 1.2 | -1.0 | -3.4 | 4.0 | 0.5 | 0.7 | 1.0 | -1.2 |

| China | 3.8 | 5.1 | 7.6 | 3.0 | 1.8 | 0.7 | 2.7 | 0.4 | 0.1 | -1.2 |

Clearly China’s performance with regard to this rather dubious measure has since 2010 been far from stellar. Yet China has little to be ashamed of. Indeed the Conference Board’s summary of long-run international trends in MFP/TFP actually flatters China:

Average TFP growth, per cent: 1999-2006, 2007–14 and projection to 2025

| 1999-2006 | 2007–14 | 2015-25 | |

| Euro Area | 0.4 | -0.4 | 0.3 |

| US | 1.0 | 0.2 | 0.2 |

| Japan | 0.7 | 0.1 | 0.7 |

| China | 4.4 | 2.0 | 0.9 |

Once we turn to a more traditional and also clearer measure of productivity, in the shape of output per worker hour, China’s improvements over the past 10 years throw its rivals on to the back foot:

Annual change in labour productivity per hour worked, per cent

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| Germany | 1.5 | 1.9 | 1.5 | 0.2 | -2.6 | 2.5 | 2.0 | 0.6 | 0.4 | 0.1 | 1.0 |

| UK | 0.6 | 2.4 | 1.6 | 0.1 | -2.4 | 1.5 | 1.2 | -1.3 | -0.1 | 0.1 | 0.3 |

| US | 1.8 | 0.8 | 1.0 | 0.8 | 2.9 | 2.6 | 0.1 | 0.6 | 0.9 | 0.5 | 0.4 |

| Japan | 1.3 | 0.7 | 1.7 | 0.2 | -0.9 | 3.9 | 0.0 | 0.7 | 1.6 | -0.6 | 0.3 |

| China | 10.7 | 13.0 | 17.8 | 11.0 | 8.6 | 4.6 | 10.7 | 7.1 | 6.5 | 7.0 | 6.7 |

We are not suggesting that China doesn’t face major challenges in productivity over the years to come: it obviously does. It’s certainly true that the productivity-boosting exodus from relatively inefficient agriculture cannot continue forever. However, if China’s net capital investment has been overdone in the past, that of the West has, it’s widely recognised, been underdone.

What about the thesis of Stephen Roach – that China’s shift to services will impair productivity growth? Here McKinsey has shown that the labour intensity of services is, nowadays, a bit of a myth. Most evidently in telecommunications, utilities and transport, but also, more surprisingly, in health and education, capital expenditures have soared enormously in the past two decades, to the extent that these sectors now turn out to be perhaps half as labour-intensive as manufacturing.

Last, let’s consider the issue of ageing. To start with, it’s worth noting that Chinese fertility halved in the decade before the one-child policy was introduced in 1979. Since then, China’s population has aged at the same time as its wealth and productivity has grown. Indeed while ageing might impair productivity, a number of sources – including McKinsey – agree that rising productivity, in China as elsewhere, should be able to compensate for any downsides that ageing might bring. It also bears remembering that older people are typically less costly to maintain than children, and that in China the rise in health life expectancy has helped create a situation in which one in five Chinese over 64 still works. And yes, older people in China save less than younger people – but that ought to boost China’s much called for (and today rather underestimated) shift from heavy production to mass consumption. In turn, more consumption by China’s older people may help the country pass the baton of productivity gains from those that surround slowing exports to the world to those that surround a growing internal market.

It may be true that almost half of China’s workers aged 50-64 didn’t finish primary education. Yet that still means that a majority did finish. It is dangerous to patronise those who didn’t as unable to contribute: indeed it may be the case that, among older Chinese who grew up or have more recently become literate, those using the Baidu search engine may do so more productively, given their experience and reading, than younger Chinese. Last, China still has time to learn to grapple with an older population. In the West, by contrast, that kind of age profile has already arrived, and we cannot claim, yet, to be adept at managing it.

Conclusion

Given China’s massive population and the West’s nervousness about that country’s rise, it is little surprise that a lot of criticism attends Chinese labour – its rising wages, its falling working population. And given the West’s low investment and what I believe to be its faltering record in innovation, it is also little surprise that plenty of schadenfreude attends Chinese excesses in investment and Chinese gaps in innovation. But what is the logic of today’s overwhelming disdain for China’s productivity prospects? Are we really saying that the Chinese are intrinsically unable, for the foreseeable future, to get closer to us in output per head? Do we really think that China lack the capability further to mechanise agriculture?

As we’ve said, China does face major productivity problems. The government’s continuing, if spottily relaxed hukou system of residency permits acts so as to impair labour mobility, and may well take a toll on productivity. Also, declining exports are an issue. By October 2015, Chinese exports had fallen nearly seven per cent from a year earlier. Now, that fact is relevant to productivity, because although exports are now less critical to China’s overall wellbeing, more contraction like this will dramatically lower the economies of scale enjoyed by Chinese manufacturers. And indeed if the Trans Pacific Partnership is signed into law by the nations involved in it, and the Transatlantic Trade and Investment Partnership comes to fruition, China – which is excluded from both the TPP and the TTIP – will likely face still smaller export volumes and still fewer economies of scale.

These things said, China’s productivity has plenty of room to improve. Although a shortage of roboticists represents a difficulty in terms of building its own brand of robots, China bought no fewer than 50,000 of such machines last year, more than 50 per cent more than in 2013; at the same time China still only has 3.6 robots per 1000 employees – for the present, an insignificant penetration compared with the US (16.4), Germany (29.2), Japan (31.4) and Korea (47.8).

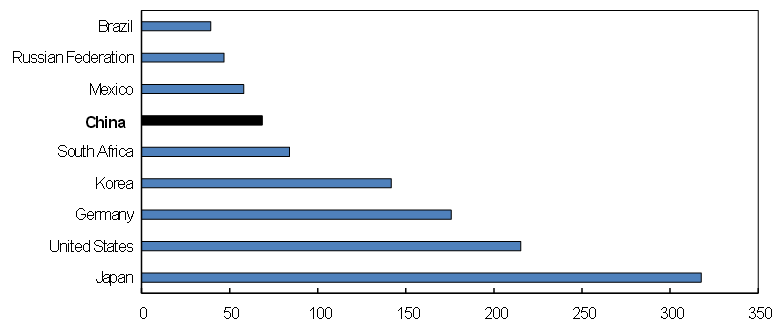

That scope for productivity growth goes further than just robots. Despite all the fuss about overinvestment in China, and despite the rapid growth in capital stock that we have described, China’s weak capitalisation per worker shows just what it could achieve:

Capital stock per employee, 2011, thousands of dollars

Unless and until strikes and political unrest deflect it from its path, the next few years and probably the next few decades will see the productivity of the Chinese economy take a complacent West aback.

Three scenarios for the future

Scenario 1: Critics confirmed Wages soar. SOEs stay sluggish. SMEs fail to get the cash to get serious about innovatory investment. The move out of the countryside slows, a development exacerbated by the continuation of the hukou system; the move into services is unaccompanied by serious capital investment. Older workers drop out of work, adding to labour shortages and thus upward pressure on wages. Alternatively, older workers fail to acquire new skills, and work badly.

Verdict: A caricature that says more about the West than it does about China

Scenario 2: A glass half full Despite a collapse in world trade, China’s consumption grows and Xi Jinping’s anti-bureaucratic reforms fail to provoke substantial opposition; also, for the most part, they work. Capital investment becomes a little more rational and a little less of a splurge. Wages rise, but at a moderate pace

Verdict: Quite possible.

Scenario 3: Uphill, but high gear Innovation, especially in capital goods and workplace IT, becomes still less imitative. China makes up ground in many of the sectors in which it is currently weak. Services and mass consumption begin to approach the modernity of the West, while general production moves to high value and rewarding wages

Verdict: The most likely scenario. The tenacity and ingenuity of the Chinese should not be underestimated

Fmr President of Kenya on Trump cutting off foreign aid:

“Why are you crying? It’s not your government, he has no reason to give you anything. This is a wakeup call to say what are we going to do to help ourselves?”

America first is good for the world.

Our entire Green Socialist establishment should be banged up under the ‘Online Safety’ laws, for spreading demonstrable lies (the ‘climate crisis’), causing non-trivial harm to the industrial working class, ordinary drivers, farmers, taxpayers etc, etc.

#Chagos? #Mauritius PM Navin Ramgoolam "is reported to want Starmer to pay £800m a year, plus ‘billions of pounds in #reparations’." (14 January) https://www.spiked-online.com/2025/01/14/the-chagos-islands-deal-is-an-embarrassment/

Now the Torygraph wakes up https://telegraph.co.uk/gift/1ff8abbb462cd609

Read @spikedonline - first with the news!

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

Eugene Polley – TV remote controls

0 comments